Key takeaways

Rapid time-to-value for the new analytics stack: Six weeks from project kickoff to production implementation

Improved, quantifiable visibility into the customer journey and experience

Increased internal efficiency across teams and operations

Achieved 100% enterprise wide data adoption by focusing on individual team needs and implementing a hub-and spoke data team model

About eMoney

eMoney Advisor provides technology solutions and services that help people talk about money. Rooted in comprehensive financial planning, eMoney’s solutions strengthen client relationships, streamline business operations, enhance business development, and drive overall growth. More than 70,000 financial professionals across firms of all sizes use the eMoney platform to serve more than 4 million households throughout the United States. eMoney’s team of more than 700 focuses on ensuring that customers have a positive, frictionless experience. The company leverages an innovative technology stack and data insights to deliver on that customer promise.

An integrated, data-first organization that focuses on the customer

Like many companies, eMoney was dealing with multiple data silos and managed several products across its internal teams and business units. It was difficult to achieve the unified, client-first mindset they were committed to with their previous tech stack. In order to gain insights into and improve their client experience even more, they felt migrating to the cloud and leveraging integrations between tools was an important and inevitable investment.

“From a technical perspective, we wanted to build a bigger footprint in the cloud, and our data stack was a great way to start. From a data perspective, the idea was to build the integrations so we could measure the customer journey and the process gaps, and then design solutions to improve flow,” shares Barrie Effron, vice president of information systems and delivery.

In addition to focusing on the client journey, the eMoney team was also committed to delivering more accessible and actionable insights across the organization for their internal users, whom they value as critical customers of their data and analytics program. To create a modern and person-first product and data experience, the eMoney team created clear criteria for their unified data solution.

The solution had to be cloud-based. The move to the cloud was inevitable and would make integration with other applications easier and faster.

Security was non-negotiable, as financial services is a highly regulated industry and of critical importance to the team.

Clear and consistent data governance at all levels was required — conflicting metrics would not help anyone and would lose trust with their internal users.

Ramp time must be rapid, ideally with a small investment in headcount.

The solution should support data self-service to help more eMoney employees access, understand, and act on data.

Looker and Etleap: a strategic technology stack

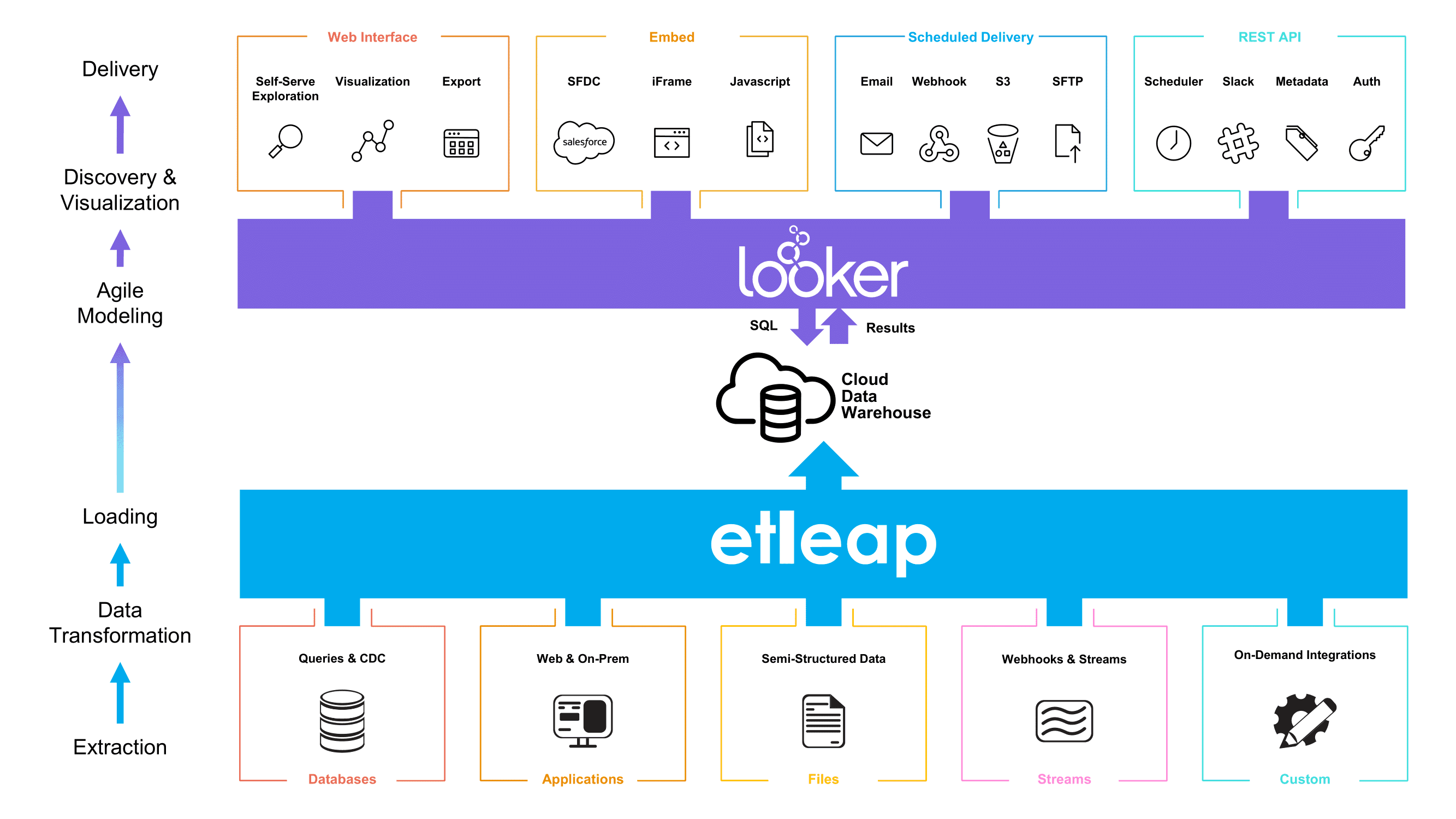

Today, eMoney runs their data solution as a full analytics stack in a virtual private cloud (VPC). They integrate data from existing on-premises and cloud services into Amazon Redshift using Etleap — running Redshift, Etleap, and Looker inside an Amazon Web Services (AWS) VPC. This allows the company to leverage the power and flexibility of the cloud while maintaining compliance with a complex set of security policies.

eMoney’s data infrastructure stack with Etleap and Looker.

The company chose Etleap as its ETL solution to centralize data from databases, applications, and hosted services into a cloud data warehouse. By leveraging Etleap’s native source integrations and data pipeline automation, eMoney was able to achieve a fast ETL build-out. “If we built it ourselves, our ramp time would be really slow, but Etleap got us up and running very quickly,” says Alicia Minella, eMoney’s data and analytics manager. Etleap connects to eMoney’s various systems, and Minella’s team controls which objects and fields are piped into AWS Redshift.

"It took six weeks to get our tech stack up and running. It only took a year to go from no central access to having full enterprise-wide Looker adoption. That’s pretty remarkable."

Barrie Effron - Vice President, Information Systems and Delivery, eMoney

eMoney selected Looker as their business intelligence platform because Looker’s modeling layer, LookML, allows the data team to define metrics once, and then ensure anyone who explores and creates reports on their own will be using the same metric definitions, achieving their data governance requirements. As Minella explains, “Governance was a focus area for us. We use LookML to create a single source of truth to ensure that when someone from sales pulls a metric and someone from marketing pulls a metric, they’re getting the same number. It’s also important that everyone really understands what that metric means, so we leverage descriptions in Looker to further build out our common language. Our goal was to have all questions pass through Looker and have everyone get consistent and correct answers.

"The Etleap and Looker partnership, and the way they came together into one solution, was a big piece of the puzzle and was very attractive to us."

Barrie Effron - Vice President, Information Systems and Delivery, eMoney

Looker also enables the company to scale usage and self-service capabilities by integrating with other tools to help deliver data experiences--from dashboards to integrations with the tools their team already uses-- across the business. “We were focused on the many ways to share data from Looker, allowing us to put data in the hands of all eMoney employees so that they can make data-driven decisions, whether it was straight in Looker, a scheduled report, or an embedded dashboard in Salesforce,” adds Minella.

Embracing the cloud securely and rapidly

As a Fintech company, eMoney must adhere to strict security standards and company data privacy policies. For this reason, the company previously deployed most of their external products and internal services on premises. However, eMoney felt migrating to the cloud was critical for the future success of their business.

They knew embracing the cloud created value for product and service deployments, including accelerated development, reduced operational burdens, and modernized infrastructure — all helping eMoney to serve their customers better.

“Going to the cloud opens up options that you don’t have otherwise. For us, security was 100% the primary consideration, and we had to find an innovative cloud option that met our standards,” explains Effron.

To begin their journey to the cloud, Effron and team started connecting with internal stakeholders to understand the factors that would lead to a successful solution and to address every concern they had. They knew it could be done, but they needed to gather support and make sure it was done right. “You have to go to the legal and security teams first. Start gathering their questions and layer those concerns into what you already know about the data. Then, weave in desired technology solutions. Seek requirements from stakeholders, and mix in industry best practice and stories from outside the org. Bring all the data points together to build your story,” shares Effron.

Throughout their evaluation and implementation process, the eMoney team was able to leverage the expertise and partnership between Etleap and Looker as they adapted to a cloud environment that would meet their strict security standards and policies. They also used their AWS VPC to extend their on-premises environment to the cloud while still ensuring they were upholding all security compliance requirements. This combination allows the eMoney team to run full analytics in the VPC, which integrates data from existing on-premises and cloud services.

Within six weeks of the project kicking off, the eMoney team was able to be up and running with a stable in production implementation thanks to fast cloud resource provisioning and managed services. On top of having a fast implementation, eMoney’s new technology stack didn’t require additional headcount or employee resources. Only two eMoney employees work within Etleap and Looker — and Minella and Effron are thrilled.

"We’ve had gains in employee efficiency. People can do their day jobs faster and benefit from the insights they’ve never had before. They can tell stories and make hypothesis statements about our work and projections that we could never do before."

Barrie Effron - Vice President, Information Systems and Delivery, eMoney

Understanding and enhancing the customer journey

Customer satisfaction and loyalty are key to the success of a subscription business. The impetus behind the data analytics project at eMoney was to go above and beyond their product and services to make sure customer experience was always the number one priority.

“We are always looking for frictionless ways to enhance our customer experience. We look at our customer journey and break it up into hundreds of discrete events. We take one step in the user onboarding journey, and we dissect it into the operations and the technology needed to support it. This is a big project, and it encompasses the technology, team, and the vision. The entire company seeks to understand all the details behind the customer journey, and we prioritize improvements together. For example, we had nine teams — from legal to marketing to training — come together to optimize the ‘zero-minute onboarding’ step,” says Effron.

The focus on customer experience has been enhanced with Looker in several ways. Customer relationship managers now leverage new insights to understand and help create even more value for their customers. Minella explains, “Our relationship management team was in the dark about some details of their accounts. They had Salesforce (SFDC) but were struggling to get details on how users in enterprise accounts were using our application. These are critical insights when you manage a relationship. With Looker, we can now share the way our users are interacting with the application — whether it’s features they aren’t using or ways they are using the product. This helps us identify opportunities to get customers into the most appropriate package and make sure they’re getting the most value out of their package.”

And, eMoney’s Client Services team can now see operational metrics integrated with other information. “It helps them understand who they’re helping, points to instances that continue to come up, and gives them product insights to improve the customer experience. It also helps to drive the product roadmap,” says Minella.

The company is surfacing these insights by centralizing data in Redshift with Etleap and then analyzing and accessing it in Looker. eMoney generates an abundance of customer data points — from Outreach, Jira, Zuora, Salesforce, Mixpanel, and more. The analytics stack is giving them unprecedented access to insights from all these sources. By centralizing data, they can collaborate among customer teams, business operations teams, and technology and product teams.

They can track metrics and trends and, ultimately, make decisions to prioritize changes to the platform and roadmap in order to optimize the customer experience.

Secure efficiency gains

With all teams at eMoney leveraging data to continuously improve, the internal financial planning and analysis (FP&A) group is especially happy to experience improved speed and efficiency. With Looker’s data governance and granulated permissioning, they can trust all numbers and easily share with internal stakeholders who need viewing access to certain metrics.

Previously, closing the books was a completely manual process, but today much of it is automated. Effron marvels that they can now “focus on the conversation and the story instead of the process of collecting and validating the data.” Since eMoney is a regulated company, the FP&A group can also trust Looker to ensure security when they need to share data. They leverage the strict permissioning capabilities so that only certain people have access to view or explore the data, down to row-level detail.

“One of the things the FP&A team likes is that they can lock down data that is specific to the finance team. Only they can explore it, but they can give ‘view’ access to other people who need it. It enables self service,” says Minella.

"We’ve had two people who work within Etleap and Looker. Two people is incredibly small in terms of headcount."

Alicia Minella - Data and Analytics Manager, eMoney

Transforming effort and project measurements

To cost out a new project or innovation, companies traditionally need to calculate the hours each team member will put into it and multiply by their respective headcount costs. With the value eMoney places on their employees, they wanted to improve the way they captured effort instead of the traditional time-focused metrics. The integrations enabled by their modern cloud data stack have allowed them to transform the way eMoney measures effort. “We are using a combination of Jira and other tools to calculate the effort of projects,” explains Effron. “With Looker, we use issue counts in Jira. We map the issue in a hierarchy of work, and we map the effort all the way up through that hierarchy.” This keeps everyone focused on customer experience without feeling like every increment of time is being measured and monitored.

It’s not just about data; it’s about people

In addition to creating an exceptional and personal client experience,these data initiatives have been equally focused on improving the workflows for internal employees. The technical implementation took six weeks, but it took close to a year to get to 100% corporate adoption. The early successes and efficiencies experienced by the FP&A team helped Minella and her team show other teams what could be done.

“The speed of data generation for the FP&A team has been increased remarkably by Looker, and the quality has been vastly improved. This was our primary investment in the beginning. All data in any organization stems from FP&A. So, starting with that business unit gave us a confidence level and footing that helped the greater adoption,” says Effron.

As they scaled the analytics stack out, Minella and her team developed a hub-and-spoke model. The data team includes three people who have trained and empowered advanced users who socialize and build trust throughout the organization. “We are asked more and more frequently, ‘Is this something we could use Looker for?’” marvels Minella. The power users in different departments are data drivers who help their own teams build looks and dashboards, socialize insights and training, and allow Minella’s team to scale support and analytics across the company.

As adoption and trust have increased, so have future plans to continue adding value for customers. eMoney plans to add machine learning to its insights to start making predictions, further enhancing its promise to deliver a top-tier customer experience.

"The Etleap and Looker solution was what we wanted, and we are able to do it in the cloud. We had to marry all the pieces in a secure way to maintain the balance of low headcount, speed, and security."

Barrie Effron - Vice President, Information Systems and Delivery, eMoney